|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Home Mortgage Rates Today: Key Features and HighlightsWhat Influences Today's Mortgage Rates?Mortgage rates fluctuate based on a variety of factors. The primary influences include the state of the economy, inflation rates, and government policies. Economic growth often leads to higher rates, while a sluggish economy might see rates drop. Economic IndicatorsIndicators such as GDP growth and unemployment rates can significantly impact mortgage rates. A thriving economy typically leads to higher rates due to increased demand for loans. Federal Reserve PoliciesThe Federal Reserve's decisions on interest rates can directly affect mortgage rates. When the Fed raises interest rates, borrowing becomes more expensive, leading to increased mortgage rates. Types of Home Mortgage RatesThere are several types of mortgage rates available today, each with distinct advantages and disadvantages.

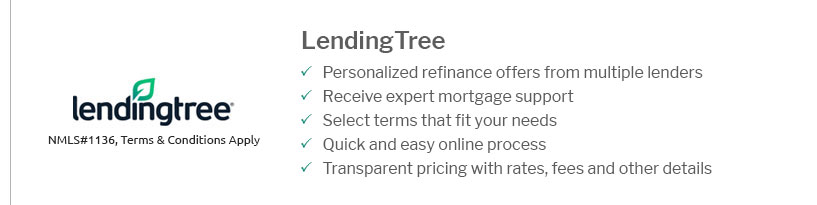

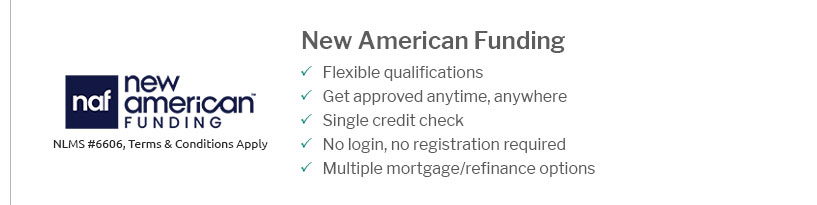

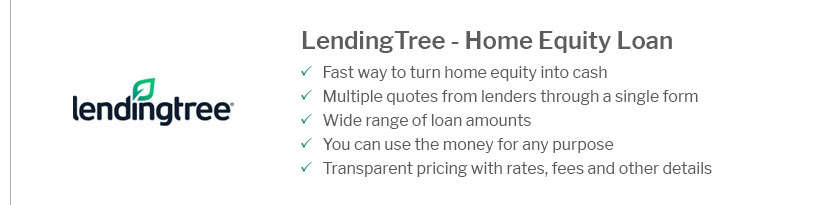

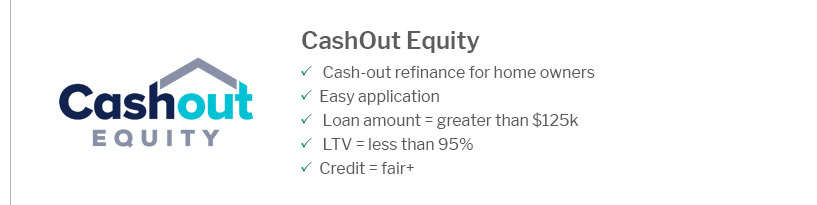

How to Secure the Best Mortgage RateSecuring the best mortgage rate requires preparation and strategy. It's essential to maintain a strong credit score, shop around, and consider various options, including refinancing your home for better rates. Improving Your Credit ScoreYour credit score is a significant factor in determining your mortgage rate. Regularly reviewing your credit report and addressing any discrepancies can help improve your score. Comparing OffersExplore the best online mortgage companies to compare different offers and find the most competitive rates. Frequently Asked Questions

https://www.wellsfargo.com/mortgage/rates/

Mortgage interest rates today ; 15-Year Fixed Rate - 5.625% - 5.872% ; 30-Year Fixed-Rate VA - 5.875% - 6.106% ; 30-Year Fixed Rate - 6.625% - 6.780% ; 10/6-Month ARM. https://www.bankofamerica.com/mortgage/home-mortgage/

Today's competitive mortgage rates ; Rate - 6.750% - 5.750% ; APR - 7.016% - 6.220% ; Points - 0.588 - 0.890 ; Monthly payment - $1,297 - $1,661. https://www.bankrate.com/mortgages/30-year-mortgage-rates/

The average rate on a 30-year fixed mortgage eased back to 6.76 percent this week, according to Bankrate's latest lender survey. In this week's big economic ...

|

|---|